6 Ways to set up allowance for children to teach money management

Teaching our kids life skills is important. Like all parents, we want to raise our kids to be productive and responsible adults, and that includes money management.

My husband and I started an allowance system for our kids when they were in preschool to help them learn some money management skills. This is a great way to introduce financial responsibility our children from a young age. They get the opportunity to track their own money.

It’s now been about a decade since we’ve been paying allowance, and we have a system down that works well for them.

Start allowance for kids young

Preschool seems young to start an allowance, but if dealing with much money is part of their lives (even in small ways) from early on, then they get comfortable with handling it.

My daughter, who is the oldest, was closer to age 5 before we started her allowance, but we started my son at age 3 since we were already in the allowance groove by then.

You don’t necessarily have to start allowance for your kids at specific ages. You can really start any time you are ready!

We pay $1 per week, per year of age. For instance, a 10-year-old gets $10 a week in allowance.

I have their allowances budgeted into our family budget to help me remember and take the expense seriously like we do other bills. Each pay day for us is an allowance pay day for my children.

You don’t have to pay $1 a week per year of age. Find whatever works for you and your family. Maybe 50-cents is more feasible for you. That’s fine.

No matter how much allowance they’re getting, kids are still learning the principles of managing money.

Set up a money management system

I’m a HUGE fan of simple systems, so our money management system of our kids’ allowance is simple. We divide allowance for kids into three parts: spending, saving and giving.

Because kids are very visual and tactile creatures, especially when they are younger, I started out distributing allowance in cash.

To keep it organized, I used one letter-sized enveloped marked “Kids’ Allowance.” Inside that envelope were three smaller envelopes for each kiddo marked with their name and either spending, saving or giving.

We put the biggest emphasis on savings to help them in the future. In order to remember how we distributed their money, I wrote it on an index card in the big envelope.

Now that I have older kids (11 and 14), I have found one of the best ways to organize their finances is digitally. I keep a kids allowance tracker in my digital notebook to remember how their money is broken down as I’m paying them.

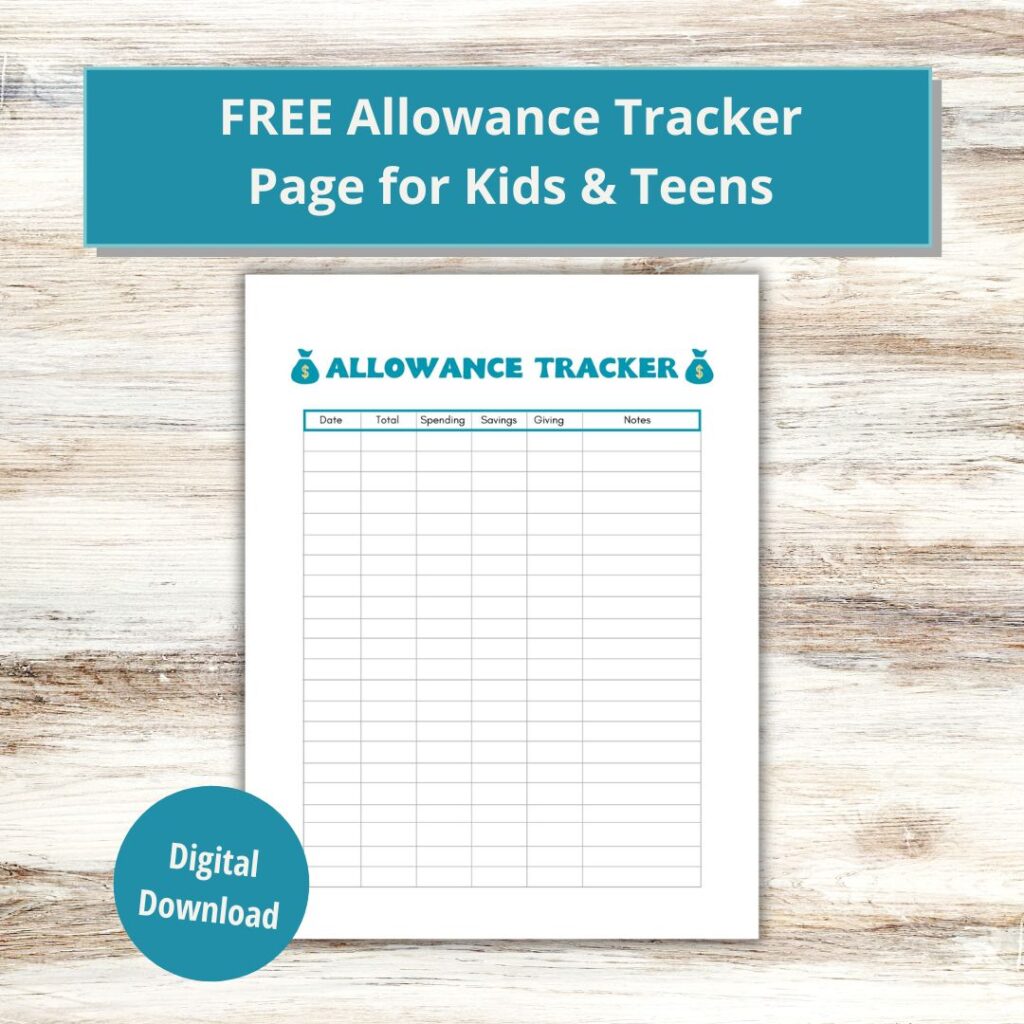

My children themselves also need a way to see their balances and learn the value of money as they decide what to spend it on. They can easily track their current balance with this free printable allowance tracker available for free download in PDF format.

The printable PDF allowance chart is a visual aid that is a great idea to help your kids see how much money they have and how it’s divided. It’s designed so that it doesn’t take much time for children to add and subtract as needed.

(Find other free printables in the FREE Families with Grace Printables Library!)

Spending

We pay for most of everything for our kiddos, including clothes, food and entertainment. But sometimes they have wants beyond what makes sense for us and our budget.

These are great opportunities for them to learn about money management as they decide whether to spend their money on what they want. Sometimes, that answer changes when I tell them it would have to come out of their spending money!

We also sometimes offer an option of splitting costs for something expensive. We agree to pay a certain portion and they agree to pay a certain portion.

When we used the envelope system, I’d grab their spending envelopes before we headed out. If we were out and they wanted to make a purchase we both knew they had money for, then I’d pay for it and they’d pay me back. We did the same for online purchases.

Now, they each have a debit card designed for children and teens. It has a special app they can log into on their phones and see how much money is in their bank account at any given time. Between that and the allowance tracker, they can stay on top of their spending money.

Right now, their debit cards are mostly in my wallet, but as my daughter gets older, that’s shifting a bit.

Savings

Not too long after we started allowance, we set them up with children’s savings accounts. For the days of the envelope system, I’d deposit money into their savings account when their savings envelope started getting full.

Now, I deposit it into the savings account tied to their debit cards. When the savings balance gets above a certain threshold, then I transfer it to their original savings account that has a higher interest rate.

Sometimes, like during 2020 when our buying changed quite a bit, I add some of their spending money into their savings as well if it starts building up.

Our kids are allowed to use their savings, but it has to be for a really compelling reason of something they need and are unable to save up for otherwise.

Withdrawing from savings also requires a discussion between the child, my husband and me. We go over options for them and talk about the pros and cons.

We’ve only withdrawn from a savings account once or twice so far. The hardest part is teaching kids about delayed gratification!

As they get older, they’ll need that money more for bigger expenses like cars, books and living expenses in college.

Giving

One of the neatest things we’ve seen happen through our system of allowance is how they use their giving money. We have talked with each of them about how they want to use their giving money.

They have the option of giving it to church, using it to help others in need or donating it to a good cause.

When we started this with my daughter, I figured she’d want to give it to church. But one of the options we shared with her was about food pantries and how some families don’t have enough to eat. She was immediately drawn to that.

As a result, our family has been quite involved in donating to local food pantries and partnering with them. Just last year my daughter did a school project about hunger and how her classmates could help. She’s organized food drives at church and at school. I love how much has grown from this allowance category!

Most recently, my kids asked to use their giving money to donate to Team Seas to help remove trash from the oceans. They have also used it to go toward building wells for areas of Africa that are without access to clean water.

Giving has become our favorite part of allowance! It has evolved into many ways that we have been able to volunteer together as a family.

Don’t pay for regular chores

My children don’t get paid for their regular chores like cleaning their rooms, cleaning their bathroom, picking up after themselves, doing dishes, folding laundry and doing other tasks we ask them to do. From the beginning, we have assigned appropriate chores for their ages that have increased in responsibility as they get older.

As family members, we consider those tasks part of family life. Life is easier when we work together! This helps establish a good work ethic.

We have sometimes (but rarely) paid for extra chores. Both sets of grandparents have done this as well, and I’m OK with that.

I have told my kids that I will withhold part or all of their allowance if they don’t do their regular chores like they’re supposed to. But, I’ve only come close to doing that twice and have never had to actually do it.

Another reason I don’t like paying for regular chores is that then my kiddos would think the chore is optional. If they’re not motivated by money (and most younger kids aren’t), then they are happy to not do the chore and not get paid.

So, we don’t pay for chores or use printable chore charts in our family.

Talk about the importance of saving

When it comes to allowance, we have found that we need to talk most about savings. Our kids easily understand spending money and giving money, but savings is a bit more obscure.

I have one child who is a natural saver, and one who is more impulsive. Talking about what they are saving money for and why is important so they understand.

Our kids have saved money short-term and long-term. We have short-term savings when they want to save up and purchase something specific.

My daughter, for example, went through a phase when she was around 7 or 8 that she wanted to buy lots of furniture and accessories for her dollhouse. She’d save her spending money until she had enough to buy the next item she wanted.

But both kids have long-term savings as well and need a bit more help with understanding why. That’s the money we put in the bank for them and then they have to have a really compelling reason to withdraw right now.

We talk about the things they can use the money for later when they are older. We want to help them them understand the important information of needing some money saved back for bigger purchases yet to come. Long-term savings doesn’t come naturally to kiddos.

Share money lessons you’ve learned

We don’t talk lots of details about our finances with our kids. But we have shared lessons we’ve learned and lessons we’ve seen others learn as well.

Kids understand concepts better when there is a story and person involved. You don’t have to share only lessons learned the hard way.

For example, we have explained to the kids that we budget our money to make sure we are covering our expenses for necessities first. And they also know about some times we saved money to purchase something.

Our money lessons have also included the importance of research before making a big purchase or financial decision. We’ve talked about and shown them when research and taking our time allowed us to find a more affordable price for something we need or want.

We don’t include our children in discussions about finances that they don’t need to be part of. I never want my children to draw inaccurate conclusions and worry about whether we have enough money to take care of them or anything else.

But I do want them to have a concept of how money works and how to manage it responsibly. An allowance gives them a chance to put those lessons into practice in small ways now that will benefit them in the future.

These are powerful tools to help our kids experience the real world of money management.

Helping with money management when they work

One of the additional tips I have needed to add in since first talking about money management for children is how to help them manage money they earn through working. My 14-year-old has been working babysitting jobs for nearly two years now.

These jobs are teaching her the value of hard work as she is able to purchase more things with the extra money she earns. Once she started earning more money, we sat down and talked about how she’d divide that money up.

She has a set amount she allows herself for spending each month. The extra money goes to her savings account one month and her college savings account the next month.

Once your child starts earning his or her own money, then talking with them about how their going to manage the extra monetary gain is important.