25 Gift ideas for men that they’ll love

Affiliate links are used in this post, if you make a qualifying purchase via my link, I receive a small percentage of the sale at no additional cost to you. I only recommend products and services I use and love. It helps support my blog, so thank you for your support! Read my full disclosure here.

Of all the people on my list, men are the trickiest for me to find the perfect gift for. I’ve looked at various Christmas gifts for men lists and often they include gift ideas none of the guys in my life would really like. Not all men are sports fanatics, meat loving, beer drinkers. In fact, none of the guys in my life are into any of those things.

So, as I was coming up with gift ideas for men this year, I figured I’d put them together in a list. That way I can remember them in the future — and I’m pretty positive other people need this kind of list, too!

These are all great ideas individually, combined together or in addition to other gifts you’re purchasing. No matter what, I’m sure you’ll find at least one thing on this list your guy will absolutely love!

Food gift ideas

Edible gifts are always a great gift idea for both men and women. Check out these tasty treats that will tickle his tastebuds!

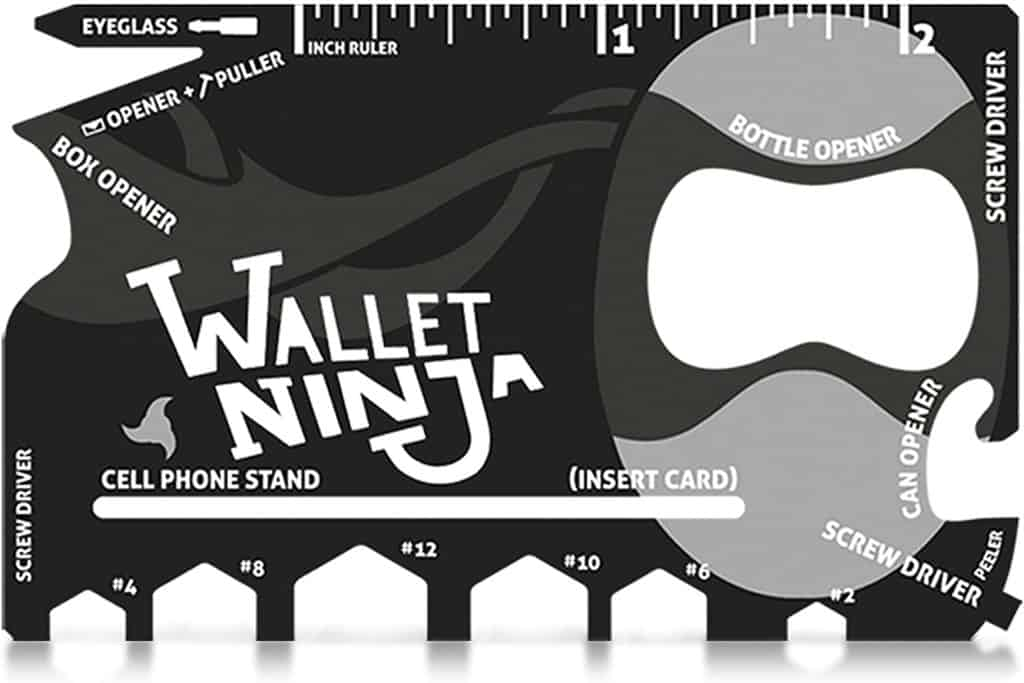

Quirky gift ideas

If you can find a Christmas gift for men that’s both quirky and useful, then you know it’s going to be a hit. Even if your guy has nearly everything, I’ll bet he doesn’t have these things!

Handy gift ideas

When it comes to gifts for men, you can’t overlook handy gifts. Check out these ideas that he’ll love even if he isn’t a big handyman!

Fun (and funny) gift ideas for him

If your guy likes a good chuckle (and who doesn’t?!), these gifts will tickle his funny bone!

Looking for more Christmas gifts for men or other people on your list? Don’t miss these posts!